Executive Summary

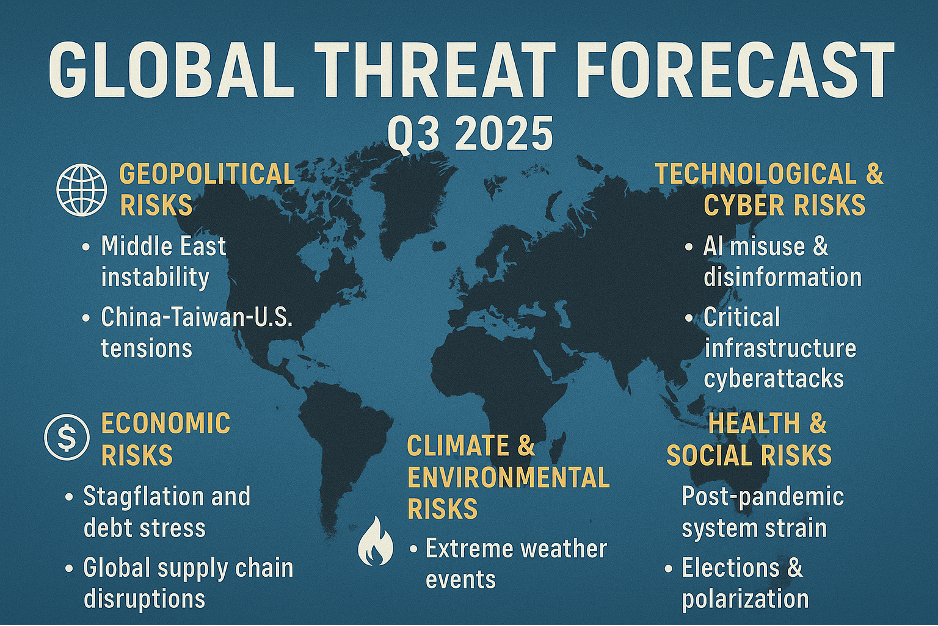

- Q3 2025 will be marked by geopolitical flashpoints, cyber and infrastructure vulnerabilities, inflation-related stress in emerging markets, and increasingly severe climate-linked events. The convergence of armed conflict, economic fragility, and disruptive technologies makes this quarter especially volatile.

Top 3 High-Probability, High-Impact Risks in Q3 2025

- Escalation in the Middle East impacting oil and global shipping.

- Cyberattacks on Western critical infrastructure during election cycles.

- Taiwan Strait incident triggering global market panic.

Introduction

The unprecedented and unpredictable events of this year’s previous two quarters are expected to continue throughout Q3 2025. From July through September, the global security landscape will continue to be defined by a convergence of traditional and emerging threats, exacerbated by the ongoing challenges of geopolitical rivalry – and alliances, technological disruptors, and environmental change. In every region, governments face the dual task of managing existing vulnerabilities while adapting to new and unprecedented threats. RMS International’s Intelligence Services assess with moderate certainty that the three biggest threats for 2025Q3 will be escalation in the Middle East impacting oil and global shipping, cyberattacks on Western critical infrastructure during election cycles, and a Taiwan Strait incident triggering global market panic.

Summary Risk Outlook for Q3 2025 | |||

Risk Category | Likelihood | Impact | Overall Risk |

Geopolitical Conflict | High | High | Severe |

Economic Volatility | Medium-High | Medium | Elevated |

Climate and Environmental | High | Medium | High |

Technological/Cyber | High | High | Severe |

Social/Health Disruption | Medium | Medium | Moderate |

Risks by Regional Breakdown

In Q3 2025, the Western Hemisphere faces a complex and evolving security environment shaped by internal instability, transnational crime, economic fragility, and cyber threats. In North America, the hyper-partisan politics heightens the risk of politically motivated violence, civil unrest, and targeted cyberattacks on electoral infrastructure. Foreign influence operations, including AI-driven disinformation campaigns, are expected to intensify. In Latin America, deteriorating economic conditions—particularly in Argentina, Ecuador, and Venezuela—are contributing to social unrest, weakening governance, and expanding opportunities for organized crime and narcotrafficking groups. Political volatility in countries like Guatemala and Peru also raises the risk of widespread demonstrations or government crackdowns. Meanwhile, border pressures and migration flows continue to strain US-Mexico relations, with criminal syndicates exploiting humanitarian and logistical gaps. Across the region, the convergence of economic stressors, weak institutions, and emerging technologies increases the likelihood of asymmetric threats and regional destabilization.

North America

In Q3 2025, North America will face an increasingly volatile security environment, largely driven by domestic political polarization, foreign cyber threats, and environmental pressures. In the United States, the presidential election season is expected to reach a fever pitch, with intensifying partisan divisions fueling widespread political rallies, contentious legal challenges, and a surge in misinformation and AI-generated propaganda. These dynamics significantly raise the risk of protests, civil disturbances, and isolated acts of political violence—particularly in swing states and major urban centers. Concurrently, critical infrastructure remains a high-value target for foreign advanced persistent threats (APTs), with election systems, financial institutions, and energy grids facing elevated risks of cyber intrusion or disruption, especially from state-linked actors in Russia, China, and Iran.

In addition to manmade threats, the region will also grapple with severe environmental challenges. Extreme heat events and wildfires are projected to intensify across the western United States and Canada, placing further strain on emergency services, power grids, and public health systems. These climate-related risks could also exacerbate displacement and resource allocation disputes at the state and provincial levels. Meanwhile, cross-border trade could face disruptions due to potential labor unrest, particularly in the transportation and logistics sectors, as well as ongoing concerns about rail bottlenecks and port congestion. Collectively, these overlapping threats underscore the need for coordinated resilience planning across federal, state, and private-sector stakeholders.

Latin America

Latin America enters Q3 2025 facing mounting security challenges driven by economic fragility, surging organized crime, environmental degradation, and social unrest. The region’s economic outlook remains unstable, with Argentina’s deepening debt crisis exacerbating inflation and fueling widespread public discontent. Meanwhile, organized criminal networks continue to expand their influence in Ecuador, Brazil, and Mexico, where high levels of violence, corruption, and state capture undermine governance and public security. In Guatemala and Peru, persistent allegations of political corruption and erosion of democratic institutions are expected to trigger renewed waves of public protest, increasing the risk of government crackdowns or political instability.

Compounding these human-driven risks are growing environmental and climate-related pressures. Accelerated deforestation in the Amazon basin is heightening drought risk in Brazil and Bolivia, disrupting water supplies and threatening agricultural productivity. In parallel, El Niño conditions are expected to stress crops across Colombia and Central America, intensifying food insecurity and migration pressures. Secondary risks include the potential for large-scale social protests linked to rising food and fuel prices, especially in countries with fragile subsidy systems or high import dependence. Additionally, shifts in U.S. policy on trade, migration, and border enforcement may reverberate across the region, affecting remittance flows, diplomatic relations, and internal displacement patterns. Overall, Latin America’s risk environment in Q3 remains defined by the convergence of economic vulnerability, political unrest, and environmental degradation.

Europe

Europe faces a complex security environment shaped by ongoing geopolitical tensions and internal challenges. The ongoing war involving Russia continues to dominate the threat landscape, with risks of escalation and spillover affecting neighboring countries, particularly in Eastern Europe and the Baltics. Economic sanctions on Russia are maintained, but there remains a high risk of asymmetric retaliation, including cyberattacks and proxy actions targeting European states and critical infrastructure.

Political instability is a concern in several countries, driven by social unrest, energy supply vulnerabilities, and rising nationalist movements. Energy security remains fragile due to disruptions in supply chains and reliance on external sources, especially amid fluctuating relations with Russia and other key suppliers. Additionally, extremist and jihadist threats persist, with some groups exploiting regional instability to plan attacks within Europe.

Cybersecurity threats continue to escalate, targeting government, financial, and infrastructure sectors, often linked to state and non-state actors. Migration pressures and humanitarian challenges linked to conflicts outside Europe also contribute to political and social strain in several countries.

Overall, Europe’s security outlook for Q3 2025 calls for heightened vigilance across military, economic, and cyber domains, with particular attention to Russia’s actions, internal political dynamics, and energy resilience.

Europe faces a complex and multifaceted security landscape in Q3 2025, with the ongoing war in Ukraine continuing to cast a long shadow over the region. Russian drone and missile strikes remain frequent, posing persistent threats to Ukraine’s critical infrastructure and raising concerns about potential spillover into neighboring NATO states. The Baltic countries, in particular, remain on high alert due to a rise in Russian hybrid activities, including disinformation campaigns, cyber intrusions, and border provocations. While direct military escalation beyond Ukraine remains unlikely, the risk of accidental or intentional incidents destabilizing the broader region cannot be dismissed.

At the same time, Europe’s economic outlook remains fragile. Stagnant growth, compounded by persistently high energy prices and inflationary pressures, is eroding consumer confidence and testing political unity within the EU. Debates over sustained aid to Ukraine and increasing immigration levels are fueling domestic tensions and polarizing electorates, particularly in countries facing elections or coalition instability. Environmental risks are also mounting, with Central and Southern Europe bracing for potential flooding or drought as climate variability intensifies. These pressures could affect agricultural output and further strain public services. Meanwhile, far-right political movements continue to gain ground across multiple member states, threatening to reshape EU policy on security, migration, and foreign affairs. Together, these dynamics point to a turbulent and politically sensitive quarter for Europe.

Middle East and North Africa (MENA)

The Middle East and North Africa region enters Q3 2025 amid heightened instability, driven primarily by the ongoing escalation of the Israel–Gaza conflict and its potential to ignite broader regional confrontations. Tensions remain high as Iran, Hezbollah, and various Syrian-based actors continue to posture militarily and rhetorically, raising the risk of cross-border engagements and proxy clashes. This environment significantly increases the threat to U.S. assets and personnel, as well as allied interests across the region. In parallel, Houthi militants in Yemen persist in targeting commercial vessels and maritime corridors in the Red Sea, disrupting global shipping routes and driving up logistical and insurance costs worldwide. These maritime threats continue to strain international trade and amplify the strategic importance of naval security cooperation in the region.

Beyond these headline risks, several states face deepening political and socioeconomic stress. Tunisia, Lebanon, and Iraq remain vulnerable to renewed political unrest due to weak governance, economic hardship, and fragile public trust in institutions. Additionally, extreme summer temperatures, exacerbated by climate change, are likely to push energy infrastructure to the brink—especially in densely populated urban centers—fueling public dissatisfaction and increasing the risk of spontaneous protests. The confluence of political instability, proxy warfare, economic strain, and environmental stressors makes MENA one of the most volatile and strategically consequential regions in the global security outlook for Q3 2025.

Sub-Saharan Africa

In Sub-Saharan Africa, key risks include ongoing coup and militia activity, particularly in the Sahel region with countries like Mali and Burkina Faso experiencing persistent instability. There is also a growing threat from jihadist groups in Nigeria and Somalia, which could further destabilize the region. Food insecurity is a significant concern, exacerbated by drought conditions in the Horn of Africa and flooding in Central Africa, both of which negatively impact food supplies. Secondary risks involve disputes over mineral resources, such as lithium and cobalt in the Democratic Republic of Congo and Zambia. Additionally, South Africa faces challenges with grid instability and potential unrest linked to upcoming elections.

Asia

In Q3 2025, Asia faces a multifaceted threat environment marked by heightened military tensions, economic vulnerabilities, and natural disaster risks. The Taiwan Strait remains a major flashpoint, with the People’s Liberation Army conducting unprecedented naval and air activities, increasing the risk of accidental conflict and creating volatility in global markets sensitive to Taiwan-related escalations. Economically, the region is challenged by a fragile recovery following the end of strict COVID-19 policies, with high youth unemployment persisting in key economies and exerting pressure on regional trade partners. The typhoon season poses significant risks to critical port infrastructure in major hubs like Shenzhen and Shanghai, threatening supply chains. Additionally, maritime disputes continue to fuel tensions, particularly between China, the Philippines, and Japan, adding to regional instability. Overall, Asia’s threat landscape in Q3 2025 calls for vigilance across military, economic, and environmental domains, as complex challenges intersect to influence regional and global stability.

Russia and Central Asia

In Russia and Central Asia, key risks revolve around the ongoing war and the pressure from international sanctions. While the Russian economy remains strained, it is considered stable, though there is a high risk of asymmetric retaliation through cyberattacks and proxy forces like Wagner-style groups. Political instability also poses a threat, particularly in Belarus and parts of the Caucasus region. Additionally, tensions between Kazakhstan and Kyrgyzstan, driven by ethnic and economic friction, carry the potential to spill over and disrupt regional energy supply chains.

China and East Asia

In the Taiwan Strait region, key risks include heightened military posturing, with the People’s Liberation Army conducting naval and air activities at record levels, raising the possibility of accidental conflict. This tension makes global markets particularly sensitive to any escalation involving Taiwan. Economically, the region faces challenges from a weak recovery following the end of COVID zero policies, compounded by persistently high youth unemployment, which also puts pressure on regional trade partners. Secondary risks involve the typhoon season, which threatens critical ports such as Shenzhen and Shanghai, as well as ongoing tensions with the Philippines and Japan over disputed waters.

South Asia

Key risks in the region include water scarcity and variability in the monsoon season, which pose significant threats to agriculture and power supply, particularly affecting hydropower generation and irrigation systems. These challenges could lead to internal displacement and unrest in rural areas. Additionally, while the India-China border remains generally stable, the Line of Actual Control continues to be a flashpoint, especially as India approaches its election period. Secondary risks involve the potential for terrorist activity in Kashmir or major urban centers, along with infrastructure strain caused by extreme heat conditions.

Arctic & Antarctica

Key risks in the Arctic region center around intensifying geopolitical competition, particularly as NATO and Russia both expand their military and strategic presence along critical Arctic shipping routes and resource-rich zones. This escalation increases the potential for confrontations and complicates efforts to manage the region cooperatively. At the same time, the Arctic’s unique climate science infrastructure faces significant vulnerabilities due to shifting geopolitical priorities and fluctuating funding commitments. These challenges threaten to undermine vital research efforts that monitor climate change impacts in the region, which are crucial not only for understanding global environmental trends but also for informing policy decisions worldwide. The intersection of heightened military activity and fragile scientific cooperation makes the Arctic a focal point of strategic and environmental risk in the coming period.

Conclusion

As Q3 2025 begins, the volatility and disruption that marked the first half of the year are expected to persist. From July through September, the global security environment will remain shaped by the convergence of traditional threats and emerging risks — including intensifying geopolitical rivalries, technological disruption, and accelerating environmental change. Across all regions, governments must simultaneously manage longstanding vulnerabilities while responding to rapidly evolving challenges. RMS International’s Intelligence Services assesses with moderate confidence that the top three threats in Q3 2025 will be: escalation in the Middle East disrupting oil flows and global shipping; cyberattacks targeting Western critical infrastructure during key election periods; and (3) a Taiwan Strait incident triggering significant financial market instability.

About RMS International:

Founded in 2012, RMS International provides ad hoc and contracted close protection, estate security, international travel management, corporate executive protection, personnel and asset security, and discreet investigative services. Operating a state-of-the-art Risk Operations Center in West Palm Beach, they provide 24/7 overwatch of global operations in Asia, Europe, Africa and throughout the Americas. RMS International delivers peace of mind in a chaotic world. Connect with us at RMSIUSA.com